arizona charitable tax credit list 2021

Tax credits are more. Arizona provides two separate tax credits for individuals who make contributions to charitable organizations.

Qualified Charitable Organizations Az Tax Credit Funds

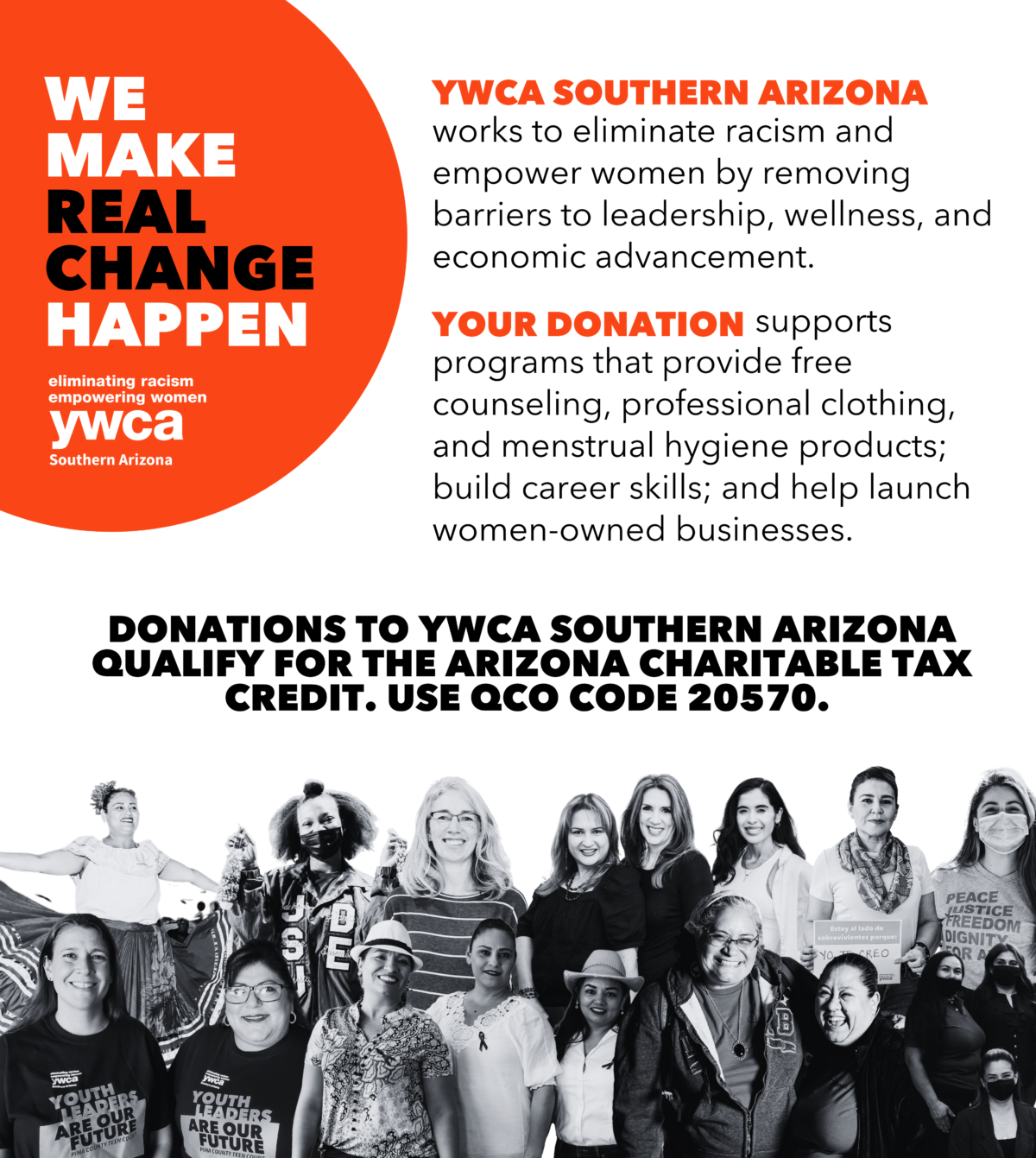

Ad Donate today to join our work.

. Ad Register and Edit Fill Sign Now your AZ DoR Form 301 more fillable forms. 400 for single heads of household and. All of these charities are state-certified options for charitable donations that qualify for the Arizona Charitable Donation Tax Credit.

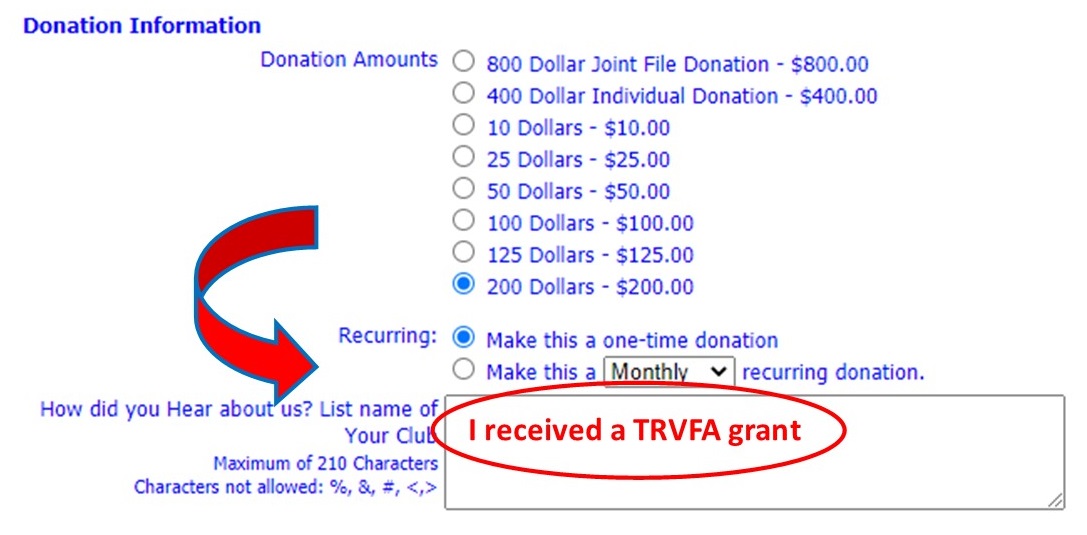

Upload Modify or Create Forms. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit. When filing your taxes in 2022 Charitable Tax Credit gifts made between January 1.

Here are some of the differences your contributions made. Donations for the 2021 tax year can be made and. Donate up to 400 single filer and up to 800.

Do note that you are required to list donations from different calendar years separately on Arizona Form 321. Tax-deductible gifts Top-rated Charity. Learn how to maximize your impact with a Schwab Charitable donor-advised fund.

Donate up to 400 single filer and up to 800. Donate up to 400 single filer and up to 800. In 2019 over 4 million tax credit dollars were donated to GiveLocalKeepLocal charities.

For the Arizona Foster Care Tax Credit that amount is 1000 for married couples filing jointly and 500 for individual taxpayers and married couples filing separately. Qualifying Charitable Organizations QCO Credit Credit for cash contributions made to certain charities Maximum credit for the 2021 tax return. Everything you need to know to take advantage of the Arizona Charitable Tax Credit updated for the 2021 tax year.

Try it for Free Now. Couples who file jointly can reduce their state taxes by up to 800. Individuals or head of household filers can claim a tax credit of up to 400.

The state of Arizona provides a variety of individual tax credits including the. Make Your Arizona Charitable Tax Donation to SOAZ Here. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit.

We live and work in 20 low- and middle-income nations where health care is scarce. The maximum credit allowed is 800 for married filing joint filers and 400 for single heads of household and married filing separate filers. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit.

You have until 4152022 to claim. Ad Salvation Army More Fillable Forms Register and Subscribe Now. Use e-Signature Secure Your Files.

Use e-Signature Secure Your Files. Upload Modify or Create Forms. Your donation may also be claimed as a.

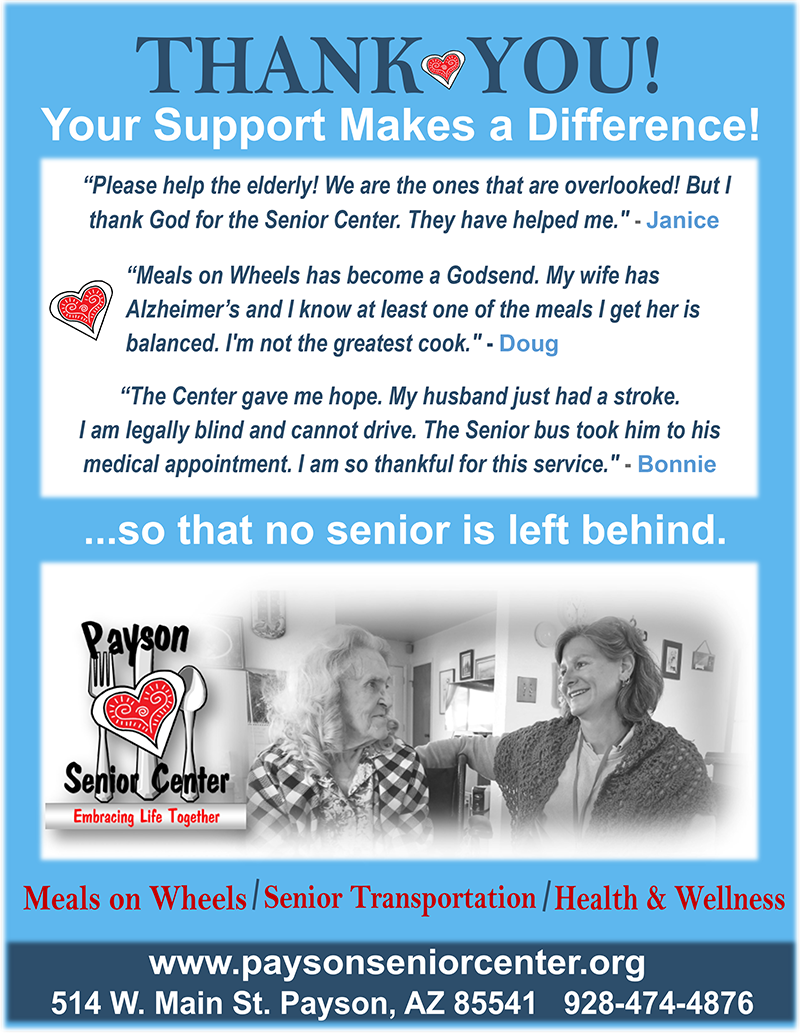

Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. 5000 high quality books given to low.

Arizona Charitable Tax Credit Give Local Keep Local

Now More Than Ever Arizona Families Need An Earned Income Tax Credit

Qualified Charitable Organizations Az Tax Credit Funds

Home State Of Arizona State Employees Charitable Campaign

Help Celebrate Our 30 Year Anniversary The Rotary Vocational Fund Of Arizona

Donate Your Arizona Charitable Tax Credit Habitat Central Az

![]()

Arizona Charitable Tax Credit Ronald Mcdonald House Charities Of Central Northern Arizona

Arizona Tax Credits Charitable Giving Tucson Phoenix Az

Arizona Charitable Tax Credit Saint Vincent De Paul

Know Each Tax Credit S Limit 2021 Fsl Org

Qualified Charitable Organizations Az Tax Credit Funds

Home Graham And Greenlee Tax Credit Coalition

Frontdoors Media Arizona Tax Credit Giving Guide 2021 22 Maricopa County Edition By Frontdoors Media Issuu

Qualified Charitable Organizations Az Tax Credit Funds

Charitable Tax Credit In Az Keep Your Tax Dollars In Tucson

Foster Care Tax Credit Arizona Friends Of Foster Children Foundation